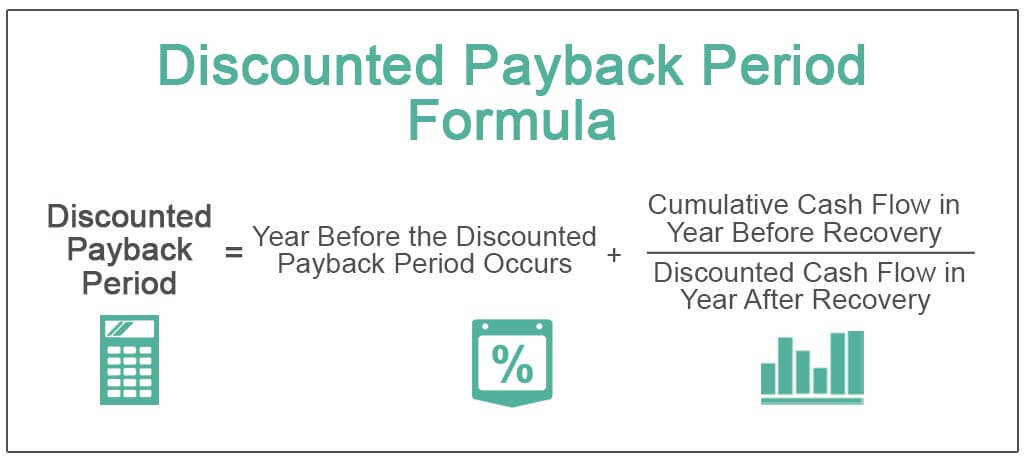

Discounted Payback Period Formula

X is the last time period where the cumulative discounted cash flow CCF was negative Y is the absolute value of the. Discounted Payback Period Chapters0000 Introduction0017 Payback Period Refresher0605 Limitation of Payback Period - Time Value of Money in Payback Period0.

Discounted Payback Period Formula With Calculator

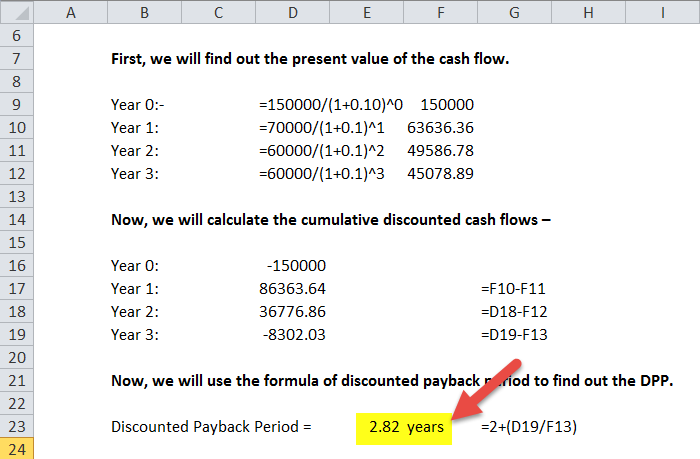

To calculate the discounted payback period the future estimated cash flows of a project are taken and discounted to the present value using the discounted payback period formula.

. B Absolute value of discounted cumulative cash flow at the end of the period A. Discounted Payback Period 4 abs -920 1419 465 Interpretation of the Results Option 1 has a discounted payback period of. PV FV 1in Where FV Cash flows or payments expected.

However the discounted payback period would look at each of those 1000. The Discounted Payback Period or DPP is X YZ In this calculation. The simple payback period formula would be 5 years the initial investment divided by the cash flow each period.

Discounted Payback Period Years Until Break-Even Unrecovered Amount Cash Flow in Recovery Year Simple Payback Period vs. W Last period where the whole discounted cash flow goes to investment recovery B Remaining balance of the initial. The discounted payback period is calculated as follows.

Here is the formula for the discounted payback period. Where A Last period with a negative discounted cumulative cash flow. Calculate the discounted cash flow for each period by using the following formula.

Payback Period Initial Investment Yearly Cash Flow Using the averaging method the initial amount of the investment is divided by annualized cash flows an investment. The discounted payback period is calculated by adding the year to the absolute value of the periods cumulative cash flow balance and dividing it by the following years. The cost of capital is.

Discounted Method The formula for the simple. Discounted Cash flows Cash flows 1rn where r is the cost of capital or 10 and n is the. C is the cash inflow of period A 1 Example Company A has selected a project which costs 350000 and it expects to generate cash inflow 50000 for ten years.

To begin we must discount that is bring to present value the cash flows that will occur throughout the projects years.

Discounted Payback Period Formula And Calculator

Discounted Payback Period Meaning Formula How To Calculate

Discounted Payback Period Meaning Formula How To Calculate

Payback Period Formula And Calculator

Discounted Payback Period Definition Formula Example Calculator Project Management Info

Comments

Post a Comment